Recent launches

💡 All the pro tips

Questions about Brex

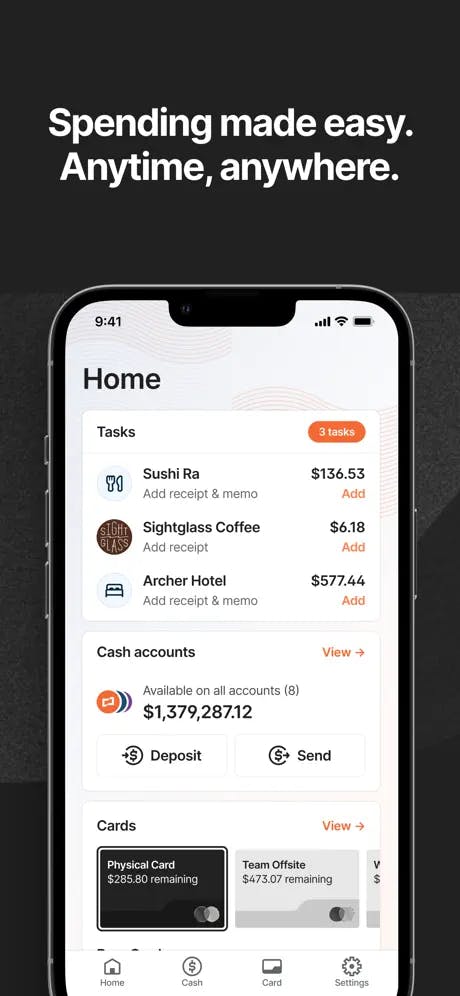

No, you cannot use your Brex card at an ATM. You cannot use your Brex card to make cash withdrawals or deposits. The card is designed specifically for business-related spending.

The Brex Mastercard is issued by Emigrant Bank, which is headquartered in New York City, New York.

No, Brex does not run or evaluate the business owner's personal credit score. Instead, Brex will evaluate the company's cash balance, spending patterns, and investors in order to determine eligibility.

According to Credit Karma, the Brex Card for Startups is "an excellent choice for startups with plenty of funding and founders who don't want the added risk of a personal guarantee should the company go out of business" Additionally, startups that do decide to go with Brex will enjoy the benefits of its rewards program, and have the opportunity to build business credit. Perks of the rewards program include redeeming points for cash, gift cards, and statement credit as well as the ability to turn points into airline miles.

Brex makes money by collecting a percentage of the interchange fee for every transaction processed with a Brex corporate credit card.

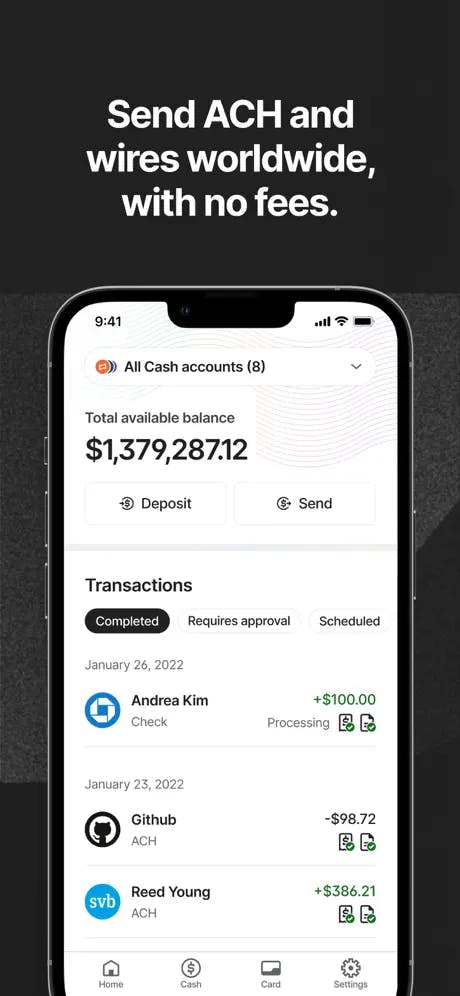

Yes, Brex is safe. As a member of the Securities Investor Protection Corporation (SIPC), any funds invested in securities are insured up to $500,000. Any uninvested funds you deposit in your Brex Cash account are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000.

Yes, Brex is legit. Brex is an American financial service and technology company headquartered in San Francisco. Founded in 2017 by Henrique Dubugras and Pedro Francheschi, Brex is actually the 2nd company that two brilliant friends started together. Both brilliant self-taught coders, the two young Brazilians first met online when they were 16 and struck up a friendship. Realizing their similar entrepreneurial tech ambitions, they decided to strike out together and in 2016, they sold their first payments company, Pagar.me, for tens of millions of dollars. Several years later, and their 2nd entrepreneurial brainchild Brex now has 10,000 corporate customers, a recent $425 million fundraising round, and more than $300 million in credit lines from Barclays and Credit Suisse. Brex is now valued at roughly $7.4 billion, and both Dubugras and Fracheschi are worth around $400 million each. Per its business model, Brex offers business credit cards and cash management accounts to technology companies. Brex has zero fees, and offers the option of investing idle funds in money market funds. As CEO and co-founder, Dubugras wants to keep Brex growing, with the hope that their company will be able to provide corporate credit cards to companies all over the world, so that "every growing company can realize their full potential."